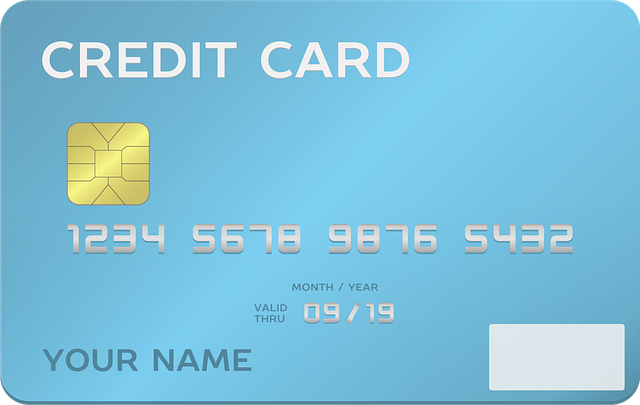

A Car title loan pink slip transfer is a security measure allowing lenders to repossess vehicles if repayment misses. Understanding this process empowers borrowers to make informed decisions and protect their rights. In case of disputes or illegal transfers, immediately gather documents, contact both lender and Texas DMV, and maintain detailed records for potential legal action. Always read and comprehend loan documents thoroughly before agreeing to any transfer.

“Confused about a sudden change in ownership on your car’s title? Our guide helps you navigate the complex world of car title loan pink slip transfers. We’ll break down the process, offering clear steps to dispute any unauthorized transfers legally. Protecting your rights is crucial; learn common pitfalls to avoid and ensure fairness. By understanding these dynamics, you can confidently assert ownership and safeguard your vehicle’s legal status.”

- Understanding Car Title Loan Pink Slip Transfers

- Steps to Dispute a Transfer Legally

- Protecting Your Rights: Common Pitfalls to Avoid

Understanding Car Title Loan Pink Slip Transfers

A Car title loan pink slip transfer occurs when the lender temporarily takes possession of your vehicle’s registration as a security measure for the loan. This process allows lenders to ensure repayment, providing them with a legal right to repossess the car if you fail to meet the loan obligations. It’s crucial to understand this mechanism, especially when considering a fast cash financial solution. In many cases, borrowers take out car title loans as a form of debt consolidation, using their vehicle’s equity for immediate funding.

The pink slip transfer is a significant step in the loan agreement, indicating that the lender has temporary control over the vehicle’s registration papers. This measure safeguards their investment and serves as a deterrent for borrowers who might default on their loans. Being aware of this process empowers you to make informed decisions when seeking fast cash or considering debt consolidation options, ensuring you understand the terms and conditions of your car title loan.

Steps to Dispute a Transfer Legally

If you believe a Car title loan pink slip transfer has been conducted illegally or incorrectly, it’s crucial to take swift action. The first step is to gather all relevant documents, including your loan agreement, any communication regarding the transfer, and proof of your original ownership. Once you have these, contact both the lender and the Texas Department of Motor Vehicles (DMV) to report the dispute.

Next, send a formal letter to the lender detailing your concerns and requesting validation of the transfer. In Fort Worth Loans, many lenders offer flexible payments plans, so ensuring the process is handled transparently and within legal boundaries is essential. If the lender fails to provide satisfactory evidence or rectifies the issue, you may have grounds for further action. Keep records of all communications and any supporting documents, as these will be vital if you need to escalate the dispute or take legal recourse.

Protecting Your Rights: Common Pitfalls to Avoid

When disputing a car title loan pink slip transfer, protecting your rights is paramount. One common pitfall to avoid is rushing into the process without understanding your legal standing and available options. Many individuals fall victim to aggressive lending practices, which may include unnecessary fees or deceptive terms. It’s crucial to thoroughly read and comprehend all loan documents before signing, ensuring you’re aware of interest rates, repayment conditions, and any associated penalties for early repayment.

Another trap to steer clear of is neglecting to gather essential documentation. In the event of a dispute, having records such as proof of income, insurance details, and vehicle maintenance history can significantly strengthen your case. Fort Worth Loans and Houston Title Loans, for instance, typically require comprehensive verification during the application process. By being proactive in collecting these documents, you empower yourself to navigate any transfer issues effectively, ensuring your rights as a borrower are upheld.

A car title loan pink slip transfer can be a complex issue, but understanding your rights and taking prompt action is crucial. By following the legal steps outlined in this article, you can effectively dispute these transfers and protect your ownership. Staying informed about potential pitfalls will help ensure you avoid common mistakes. Remember, navigating such situations requires diligence, so take a dive into your rights and don’t let an unfair transfer stand.