Before transferring a car title loan pink slip, research state laws and understand rights/responsibilities to avoid legal pitfalls. Verify loan terms, compare offers, review documents thoroughly to protect against exploitative practices. Secure vehicle documentation accurately and manage financial obligations for a smooth transfer process.

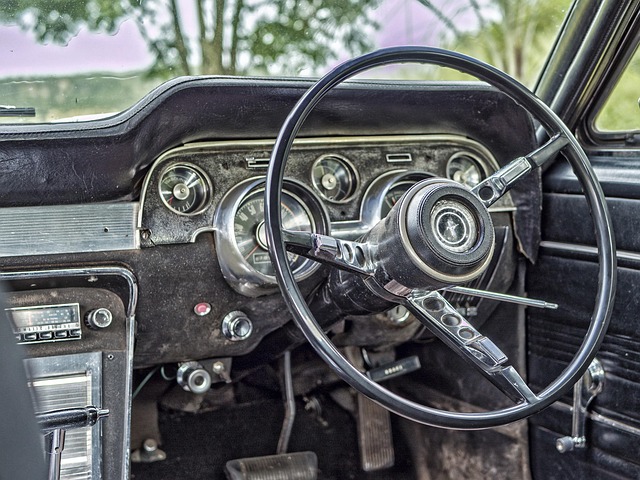

When considering a car title loan, one of the critical steps is navigating the process of transferring the pink slip. This guide outlines essential mistakes to avoid during this crucial phase. Before initiating the transfer, understanding legal requirements is paramount. Verifying loan terms, interest rates, and ensuring proper documentation—including the vehicle’s registration and proof of insurance—are vital safeguards. By adhering to these practices, borrowers can ensure a smooth transfer process and maintain their vehicle’s integrity.

- Understand Legal Requirements Before Transfer

- Verify Loan Terms and Interest Rates

- Safeguard Your Vehicle's Documentation

Understand Legal Requirements Before Transfer

Before initiating a car title loan pink slip transfer, it’s crucial to familiarize yourself with the legal requirements governing the process. Different states have varying regulations regarding title transfer for secured loans, including car title loans. Ignoring these rules can lead to significant legal and financial complications. The last thing you want is to find yourself in a sticky situation because you overlooked a requirement during what might seem like a straightforward transaction.

Researching the specific laws applicable to your location ensures that both parties involved – you, the borrower, and the lender – understand their rights and obligations within the title loan process. This knowledge will help protect you from unexpected charges or penalties and ensure a smooth transition of ownership for your vehicle. Additionally, understanding legalities can help you negotiate better terms, including keeping an eye on interest rates, to get the best deal possible during the transfer.

Verify Loan Terms and Interest Rates

Before agreeing to a car title loan pink slip transfer, it’s crucial to verify the loan terms and interest rates offered by the lender. This step is essential to ensure you understand fully the financial commitment you’re entering into. Make sure to ask about any hidden fees or additional charges that could impact your overall cost. Lenders are required to disclose all terms clearly, including interest rate calculations and repayment schedules. Failure to do so could lead to unexpected expenses down the line.

When considering a car title loan pink slip transfer, especially for high-value assets like semi trucks, compare offers from multiple lenders. This process allows you to shop around and find the most competitive rates and terms. Keep in mind that a “no credit check” policy might sound appealing, but it often indicates higher interest rates or less favorable conditions. Thoroughly reviewing the Title Transfer documents will help protect you from exploitative practices and ensure a smooth financial experience.

Safeguard Your Vehicle's Documentation

When navigating a car title loan pink slip transfer, safeguarding your vehicle’s documentation is paramount. This process involves ensuring all titles, registration papers, and other relevant documents are securely stored and easily accessible. Before transferring ownership, double-check that the paperwork accurately reflects the sale details to avoid any discrepancies later on. A simple mistake in this documentation can lead to delays or even legal issues down the line.

During the transfer process, consider your financial obligations as well. While focusing on completing the legal aspects, don’t forget to manage your emergency funds and payment plans. Keeping these in order will ensure a smoother transition and give you peace of mind, especially if unexpected expenses arise. Remember, loan approval is just the beginning; proper document management and financial planning are crucial for a successful car title loan pink slip transfer.

When transferring a car title loan pink slip, adhering to legal requirements, verifying loan terms, and safeguarding documentation are crucial steps to avoid pitfalls. Understanding these aspects ensures a smooth process, protects your rights, and secures your vehicle’s future. Always remember that informed decisions lead to less stress and better outcomes when navigating financial transactions involving your vehicle.